PEPPOL, an e-invoicing and e-procurement platform, was implemented in Canada in 2018. It enables firms to send and receive invoices electronically while tracking orders and payments.

Peppol is a cloud-based platform that facilitates invoicing and procurement between enterprises and government agencies, altering the old business model. The Peppol platform is founded on an Austrian government effort and is currently utilized in over 35 nations globally.

Peppol is making it simpler for Canadian businesses to do business with the government. Peppol covers you whether you want to submit an invoice or discover a supplier!

Continue reading to discover more about Canada’s e-invoicing rules, who they are intended for, and how to send and receive compliant electronic invoices.

What are the norms and procedures for e-invoicing in Canada?

Although e-invoicing is not yet mandated in Canada, the Canadian government is moving toward this aim. Following the Minister of Public Works and Government Services Canada’s mandate in 2018, all federal vendors were required to accept e-invoices by the end of that year.

While e-invoicing is not yet required, the Canadian government actively urges enterprises to begin utilizing them. In reality, the government has formed a task group to investigate the viability of e-invoicing and how it may be implemented at all levels of government.

To send and receive invoices in Canada, businesses must follow the following laws and regulations:

Storage

Every company that employs e-invoicing must have a system in place to keep invoices. The storage method should ensure the invoices’ confidentiality, integrity, and availability. When required, the bills should also be easily accessible.

Archiving

Invoices must be kept for at least six years. You may accomplish this online to guarantee that your invoices are simple to locate and retrieve when required.

Format

The Canadian government requires all e-invoices to be in Universal Business Language (UBL) format. This is an international standard that assures the interoperability of various software systems. The format lets companies include additional information on their invoices, such as terms and conditions.

Payment information

Invoices must contain all pertinent information, such as the date, invoice number, and a description of the products or services sold. Furthermore, companies must offer their contact information and the customer’s contact information.

Taxes

Taxes must be included in all e-invoices. This includes the following:

- The PST (Provincial Sales Tax) is a tax imposed on the sale of goods and services in Saskatchewan. It is often a tax on the final consumption of goods and services.

- GST (Goods and Services Tax) is a tax imposed in Canada on the sale of goods and services. The GST is a value-added tax applied on final consumer products and services.

Who is in charge of e-invoicing and e-procurement in Canada?

E-invoicing and e-procurement are referred to as “e-services” by the Canadian Revenue Agency. The CRA is in charge of implementing and enforcing Canada’s tax laws.

The Canadian government has also formed a task group to investigate the viability of e-invoicing and how it may be implemented at all levels of government. The E-Invoicing Advisory Group is the name of this task group. It is made up of governmental and private sector representatives.

Who in Canada is required to follow e-invoicing regulations?

E-invoicing is not yet required in Canada, although the Canadian government is moving toward this aim. In 2018, the government ordered that all federal vendors accept e-invoices.

E-invoicing will most likely become essential for all Canadian firms in the future. However, only businesses that sell to the government are now required to follow e-invoicing requirements.

Advantages of E-Invoicing for Canadian Businesses

E-invoicing for Canadian corporations provides various advantages, including:

Digital documents are easily accessible.

It is simple to access and handle digital materials when employing technology and software. You may also keep them online, saving physical space in your company. Most essential, the records may be readily retrieved when required.

Payments are made more quickly.

Businesses may be paid quicker using e-invoices since they can send invoices electronically, and consumers can pay them online. Furthermore, companies may set up automated payments to be paid as soon as the invoice is received.

Increased cash flow

E-invoicing may help firms improve their cash flow by shortening the time it takes to receive payment. Invoices may be sent electronically, and consumers can pay them online. This may assist firms in avoiding late fees and interest costs.

Digital signatures are used to confirm the validity of documents.

Digital signatures assist in guaranteeing the authenticity of a document. They use a distinct digital ID that the receiver may validate. Furthermore, digital signatures may aid in ensuring that a document has not been tampered with.

Enhanced client service

E-invoicing may assist businesses in providing better customer service. Invoices may be sent electronically, and consumers can pay them online. Furthermore, companies may set up automated payments to be paid as soon as the invoice is received.

Reduced forgery and fraud risk

Paper invoices are less secure than electronic invoices. This is because they may be encrypted and password-secured. Furthermore, organizations may add security measures to their invoices, such as digital signatures.

Quick and error-free tax preparation

Businesses that employ e-invoicing may create tax reports automatically. This may help companies save time and prevent mistakes that result in interest and fines when completing their taxes.

Costs of compliance are being reduced.

E-invoicing may assist firms in lowering their compliance expenses. This is because firms may create tax reports automatically. Furthermore, companies may set up automated payments to be paid as soon as the invoice is received.

Data encryption to aid in the reading of a text

When an organization employs encryption, it may aid in the preservation of a document’s readability. This is due to the fact that the data in the document is changed into a code that only someone with the key can read in order to decode it.

In Canada, how do you send and receive compliant e-invoices?

Canada has yet to implement an e-invoicing standard. The Canadian government, on the other hand, is striving to establish one. Meanwhile, companies may utilize Peppol to send and receive electronic invoices.

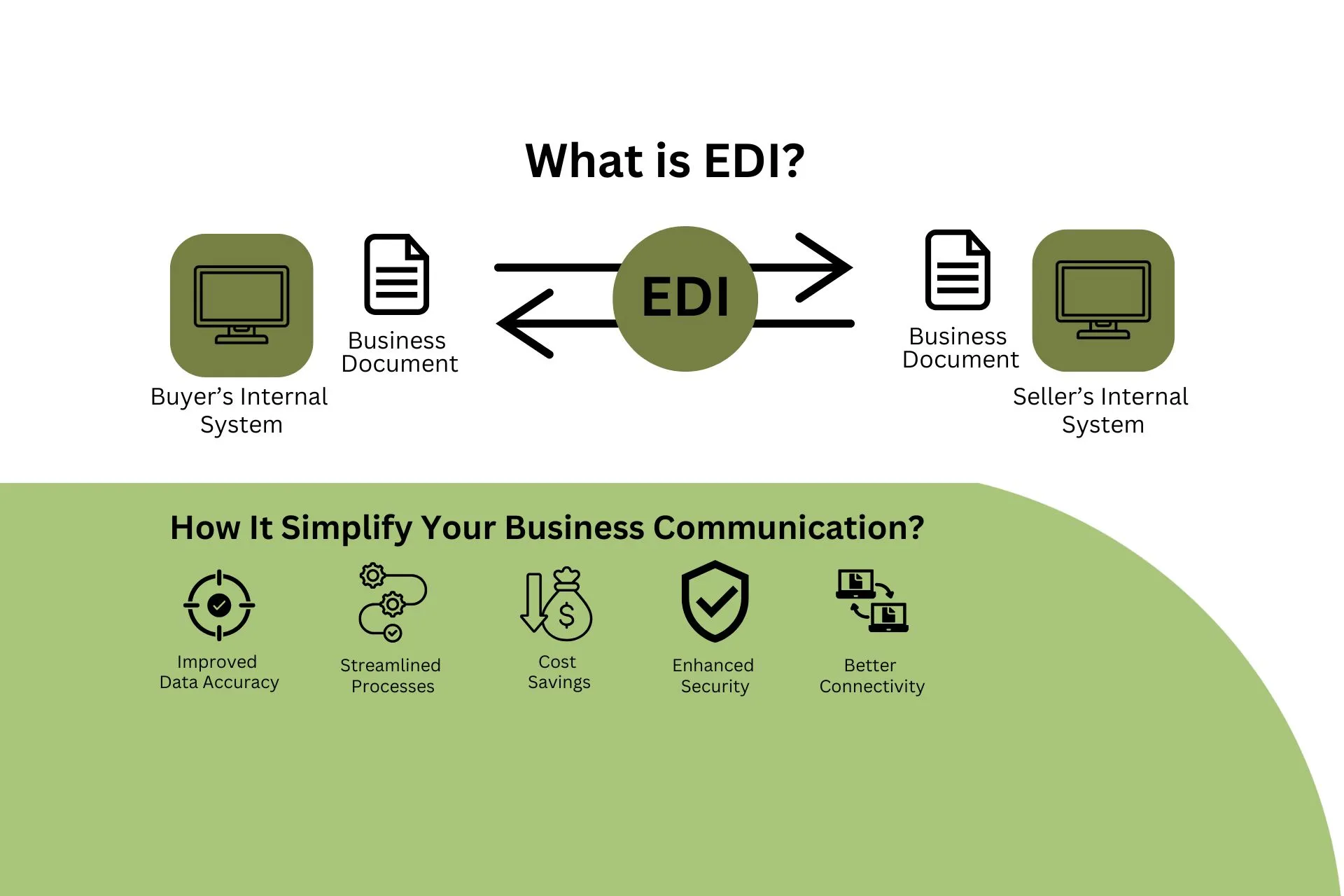

The Pan-European Public Procurement Online (PEPPOL) network is a European effort that allows companies to send and receive electronic invoices. PEPPOL is already being used by businesses in Canada in the following steps:

1. Using business software to create an invoice

Using its accounting software, the company generates an e-invoice. Businesses must include precise information when preparing an invoice, such as:

- The company’s name and address

- The customer’s name and address

- The date of the invoice

- The deadline

- The bill number

- A description of the items or services offered for sale

- The number of items or services sold.

2. Access Point Peppol

The invoice is then sent to the client through a Peppol Access Point. A Peppol Access Point is a web-based platform that enables companies to send and receive electronic invoices. Businesses must complete the following procedures to register for a Peppol Access Point:

Register with a Peppol service provider.

Choose a unique identification for your company, such as a duns number.

Obtain a digital certificate.

HubBroker is a Certified Peppol Access Point Provider that allows companies to send and receive electronic invoices. It is a cloud-based tool for businesses to manage their invoicing.

3. Invoice distribution

The invoice is subsequently sent to the client through the Peppol Access Point. The consumer will be notified through email that they have received an invoice.

4. The Peppol Access Point of the consumer

The invoice will be sent to the consumer through their Peppol Access Point. After then, the consumer may examine the invoice and make a payment.

5. Compensation

The consumer may now make a payment. The payment will be completed, and the money will be deposited to the account of the company.

6. Payment Receipt

The company will then be notified that their payment has been completed and monies have been sent to their account. This concludes the e-invoicing procedure.

How Canada assures compliance with e-invoicing

Canada currently lacks a standard for ensuring e-invoicing compliance. The Canadian government issued a consultation paper on e-invoicing in 2018, proposing the following actions to assure e-invoicing compliance:

Creating a legal framework

The Canadian government is developing a legislative framework for e-invoicing. This legislative framework will outline the norms and procedures for e-invoicing in Canada.

Creating guidelines

The Canadian government is striving to create e-invoicing standards. These guidelines will guarantee that e-invoices comply with Canadian legislation.

Developing a system of accreditation

The Canadian government is developing an e-invoicing accreditation scheme. This certification system will verify that firms satisfy the e-invoicing criteria.

Putting in place an enforcement mechanism

The Canadian government is developing an e-invoicing enforcement instrument.

Conclusion

E-invoicing is becoming more popular in Canada. The Canadian government is building a legislative framework and standards for e-invoicing compliance. Meanwhile, companies may send and receive e-invoices via Peppol Access Points.

HubBroker is a Certified Peppol Access Point Provider that allows companies to handle invoicing. Contact us now to begin using our e-invoicing solutions and discover how we might benefit your company.