Key Regulations and Changes

Denmark has mandated digital accounting systems for businesses, marking a significant departure from traditional paper-based methods and ushering in a new era of financial efficiency and transparency.- Digital Mandates: Businesses across Denmark are now legally required to implement digital accounting systems. This transition from paper-based records aims to streamline financial processes, improve accuracy, and enhance efficiency.

- Data Retention: To ensure compliance and accountability, companies must retain digital records and attachments for at least five years. This requirement is crucial for auditing, tax purposes, and resolving potential disputes.

- Security Standards: Given the sensitive nature of financial data, the Bookkeeping Act imposes stringent security standards on accounting systems. Businesses must implement robust measures to protect their data from unauthorized access, breaches, and other security threats.

- e-Invoicing: Denmark has been a forerunner in the adoption of e-invoicing, making it mandatory for government transactions since 2005. This early embrace of electronic invoicing has paved the way for a more digitized and interconnected business ecosystem.

Understanding Denmark’s Digital Bookkeeping Timeline

The implementation of Denmark’s new Bookkeeping Act is being phased in over several years to allow businesses and software providers time to adjust to the new regulations. Here’s the timeline:- February 2023: Standard accounting systems become mandatory.

- January 2024: Notified systems will be registered.

- January 2025: Businesses using non-registered systems must switch to digital accounting.

- July 2026 (or later): Non-accounting companies with a net turnover exceeding DKK 300,000 must comply with the digital accounting rules.

Benefits of the Digital Bookkeeping Act

Digital bookkeeping offers advantages that go beyond meeting the requirements of the new Danish Bookkeeping Act. By embracing digital solutions, businesses can improve efficiency, accuracy, decision-making, and overall financial management.- Real-time Access: Digital accounting systems can be accessed from anywhere with an internet connection, enabling seamless collaboration among team members and external stakeholders.

- Centralized Platform: A centralized digital platform provides a single source of truth for financial information, eliminating the need for multiple spreadsheets or paper documents.

- Version Control: Digital systems often have built-in version control features, allowing you to track changes to financial data and revert to previous versions if necessary.

Enhanced Security:

- Data Encryption: Many digital accounting systems employ advanced encryption techniques to protect sensitive financial data from unauthorized access.

- Access Controls: You can implement granular access controls to restrict access to specific data or features based on user roles and permissions.

- Disaster Recovery: Cloud-based systems often have built-in disaster recovery features that can help protect your data in case of hardware failures or other disruptions.

Cost-Effective:

- Reduced Paper Costs: Eliminating paper-based records can significantly reduce printing, storage, and filing costs.

- Improved Efficiency: Automated processes can lead to increased productivity and reduced labor costs.

- Scalability: Digital systems can easily scale to accommodate business growth without significant additional costs.

Environmental Benefits:

- Reduced Paper Consumption: By transitioning to digital records, businesses can reduce their environmental footprint by minimizing paper consumption and waste.

- Improved Sustainability: Digital accounting practices can contribute to a more sustainable and environmentally friendly business model.

E-Invoicing in Denmark

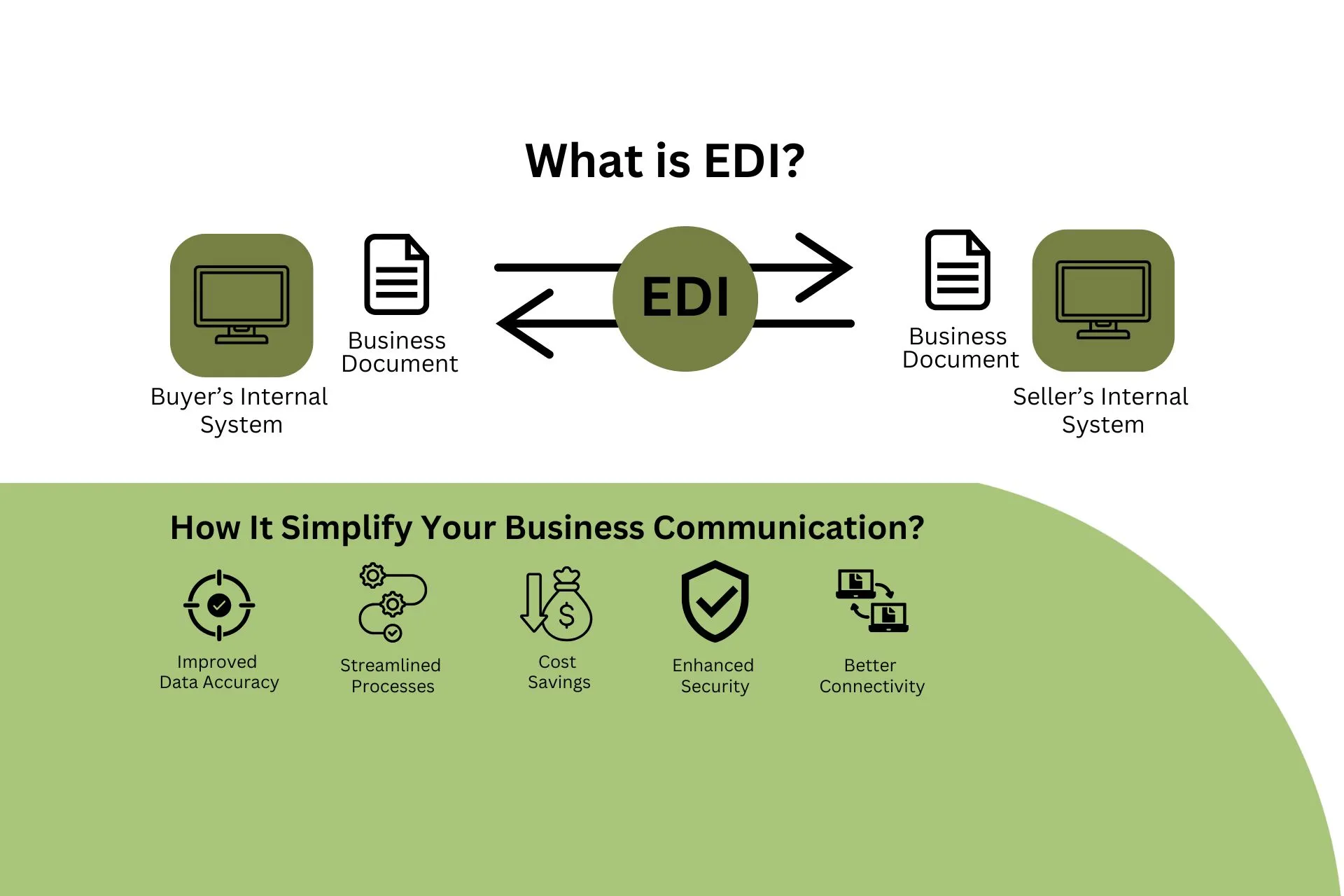

The Danish government has been using e-invoicing since 2005, requiring both government agencies and their suppliers to use a specific format called Peppol BIS 3.0 through the Peppol network. This system connects with public entities registered in the national SMP NemHandel. Denmark is also exploring the use of electronic ordering and cataloging for certain types of goods to promote e-commerce in the public sector. In the business-to-business (B2B) sector, companies can choose to use e-invoicing if both parties agree to do so.How Our EDI Solutions Can Help You Navigate Denmark’s New Bookkeeping Act

Danish businesses can use our EDI solutions to streamline processes, improve data accuracy, and enhance efficiency, ensuring compliance with the new Bookkeeping Act.1. Streamlined Data Exchange:

- Electronic Invoicing: Our EDI solutions can automate the creation, transmission, and receipt of electronic invoices, ensuring compliance with the new act’s requirements for digital invoicing.

- Purchase Order Automation: EDI can automate the exchange of purchase orders and invoices between suppliers and customers, reducing manual errors and improving efficiency.

- Shipping Notifications: EDI can automate the exchange of shipping notifications, ensuring accurate and timely updates of order status.

2. Enhanced Data Accuracy and Integrity:

- Data Validation: EDI solutions can validate data to ensure accuracy and consistency, reducing the risk of errors and discrepancies in your accounting records.

- Reduced Manual Data Entry: By automating data exchange, you can significantly reduce manual data entry, minimizing the risk of human errors and improving data quality.

3. Improved Efficiency and Cost Savings:

- Faster Processing: EDI can accelerate business processes, reducing turnaround times and improving cash flow.

- Reduced Paperwork: By eliminating paper-based documents, EDI can help reduce costs associated with printing, storage, and handling.

- Enhanced Auditability: EDI provides a clear audit trail, making it easier to track transactions and comply with regulatory requirements.

- Seamless Integration: Our EDI solutions can be seamlessly integrated with your digital accounting system, ensuring a smooth data flow and reducing the risk of errors.

- Automated Data Transfer: EDI can automate the transfer of financial data between your accounting system and trading partners, eliminating manual data entry.

- Adherence to Standards: Our EDI solutions comply with industry standards and best practices, ensuring your business complies with the new Bookkeeping Act and other relevant regulations.

- Simplified Audits: EDI can simplify the audit process by providing a clear and traceable record of transactions.