A recent survey shows that over 50% of businesses have experienced email scams targeting their accounts payable departments. To protect against fraudulent invoices and overpayments, it’s crucial to implement a robust invoice approval process that includes three-way matching.

What is 3-Way Matching?

3-way matching is a critical step in the procurement process that involves cross-referencing three essential documents: the purchase order, the receipt, and the vendor invoice. By comparing these documents, the accounts payable department can determine whether an invoice is valid and should be paid.

During the 3-way matching process, the AP specialists answer the following questions:

- What was ordered?

- What has been delivered?

- What are we expected to pay for?

The goal is to identify discrepancies in the purchase order, receipt, and invoice and resolve them before payment.

In this blog, we will cover the following topics related to 3-way matching:

- How the 3-way matching process works

- Who are the stakeholders involved in the process

- Other available matching options

- Common discrepancies found during the matching process

- Benefits of implementing 3-way matching

- Potential challenges of 3-way matching

- Tips for optimizing the matching process

- How automation can streamline the process

How Does 3-Way Matching Work?

After receiving an invoice for delivered goods, the accounts payable department begins the 3-way matching process by reviewing the following documents:

Purchase Order Verification

The first step is to locate the corresponding purchase order, including details such as the buyer’s and seller’s information, contract information (if relevant), item description, quantity, price, payment details, and delivery terms. The AP department checks whether all the information recorded in the purchase order is accurate.

Delivery Verification

Next, the AP team reviews the delivery receipt or packing slip to confirm the delivery contains the correct items and quantity. This document confirms the order’s delivery and includes details of the shipped items or provided services.

Invoice Verification

Finally, the accounts payable staff reviews the invoice details to confirm what they are expected to pay. The invoice must contain information similar to the purchase order, including the buyer and vendor contact information, date of issue, a short description of items, their quantity, the price for each, the total amount due, payment terms, and any applicable discounts.

The AP team compares the information on the invoice to that on the purchase order and delivery receipt to ensure they match.

By conducting a 3-way matching process, businesses can reduce the risk of fraudulent invoices, overpayments, and non-compliance. It also helps to streamline the procurement process and improve accuracy.

Stay tuned to learn more about the benefits, challenges, and optimization tips for implementing 3-way matching.

Collaboration is Key in Three-Way Matching

Three-way matching is not just a task for one person or department in a company; it involves the participation of several departments and vendors. These stakeholders include:

- The purchasing department, which makes purchases on behalf of the company

- The inventory department, which receives and inspects goods and tracks receipts

- The accounting department, which pays invoices

- Vendors and suppliers who have a reputation to uphold and expect timely payment

Suppose there are any discrepancies during the matching process. Payment will not be issued in that case, and the involved parties will work together to resolve the issues. Once an invoice has been validated through the three-way matching process, payment can be sent.

Multiple Options for Matching

While three-way matching is the industry standard, organizations may choose to use two-way or four-way matching depending on their specific needs.

Two-way matching is a simpler process that involves comparing purchase orders and invoices. It is used when order receipts are not issued or in cases of recurring payments. For example, two-way matching may be sufficient when paying for a software subscription.

Four-way matching is a more rigorous option involving additional verification by someone who has witnessed the delivery or service. This can include physical inspections or verbal confirmation that the service has been successfully rendered.

Each organization determines which matching process best suits its needs. Processes may also vary depending on suppliers and contracts associated with the purchase order.

For example, an accounts payable team may skip delivery receipts for recurring purchases from a long-term partner vendor. Alternatively, they may add an extra step of personal inspection for a newly contracted vendor not well known in the market.

While organizations may choose to use different matching processes, three-way matching is widely regarded as the gold standard as it provides security by comparing essential order information while remaining simple and efficient.

Identifying Common Discrepancies in Three-Way Matching

The three-way matching process is crucial in the buying process as it ensures that all purchases are accurately reflected in the company’s financial records.

While everyone involved in the process hopes for a smooth transaction, discrepancies can still occur. In fact, finding discrepancies is an indication that the three-way matching process is efficient.

Here are some of the common issues that can arise during the matching process:

Incorrect Pricing or Total

Incorrectly reflected costs could be due to a simple data entry error or a mistake in choosing the wrong item ID during the price search. However, incorrect pricing can also indicate fraudulent activity on the supplier’s side. Double-checking the cost against internal records can help clarify the situation.

Wrong Tax Amount

Taxes can be confusing in business, and international transactions are particularly susceptible to tax miscalculations. Vendors in another country may incorrectly calculate taxes based on the wrong regulations. Tax issues also arise with any other cost discrepancies since tax is determined based on the price of goods.

Inaccurate Shipping Volume

Shipping discrepancies can arise if the wrong amount of goods is shipped or if something happens during transportation. Prompt action by the finance team is important in such cases. An incorrect shipment volume could also result in an incorrect vendor invoice.

Damaged Items

Goods can be damaged during transportation, resulting in an altered invoice or repeat shipment request. In such a case, delivery receipts wouldn’t pass the three-way matching process.

Missing Receipt

A missing shipment confirmation complicates delivery control, which could mean that the receipt wasn’t issued when expected, was misplaced, or was lost.

Duplicated Documents

Purchase orders may be sent several times, or invoices may be issued twice, especially when the purchasing process is managed manually via email. In most cases, a duplicated invoice is usually an honest mistake. But it is worth checking to ensure an invoice hasn’t been falsified.

Item Repetition Across Multiple Invoices

Vendors may accidentally repeat an item in more than one invoice when issuing several invoices for the same company. This leads to an imbalance between what they are requested to pay and what they should actually pay, unnecessarily complicating invoice matching.

The Benefits of Three-Way Matching

The three-way matching process may seem tedious and complex. However, it is crucial to prevent financial losses, keep financial records in order, and build long-term trustworthy partnerships with vendors. Here are some benefits of the three-way matching process:

Improve Profitability/h3>

Three-way matching can prevent financial losses due to duplicate payments, fraudulent invoices, or human errors, thus boosting a company’s bottom line. Fake invoices can be difficult to distinguish from real ones, but the absence of a related purchase order or receipt makes it easy to recognize fraud.

Three-way matching also brings to light discrepancies or human errors, making it possible to fix them quickly and avoid late-payment penalties.

Prepare for an Audit

Auditors actively look for financial discrepancies, so having all documents matched and prepared in advance for the review will be favorable for the company’s credibility. Three-way matching is a sign of a financially responsible company.

Improve Supplier Relationships

Regular and prompt three-way matching makes building trusting relationships with vendors and suppliers easier. Confirming documents on time and paying invoices promptly makes trading partners feel valued.

If discrepancies are found during three-way matching, it’s essential to communicate them clearly and cooperate on solving the issues. Organizations will improve vendor relationships and build long-term trustworthy connections with 3-way matching.

Moreover, when there are regular mistakes on the supplier’s side, and it doesn’t seem to get better, it might be time to consider looking for other partners who can provide more quality and certainty.

Challenges of Three-Way Matching

While three-way matching brings undeniable benefits to the company’s procurement process, it also comes with its fair share of challenges, particularly when done manually.

Time-Consuming and Labor-Intensive

Reviewing documents in three-way matching can be time-consuming and requires significant effort. Each of the three documents contains substantial data to analyze, especially for larger orders.

The manual matching process can be a serious challenge, particularly when many invoices pile up, such as during peak production seasons. Staff may not have the time to process them, leading to delays in payment and potential fines.

The process becomes even more challenging when discrepancies are found. Correcting the problems one by one requires numerous emails, phone calls, or even warehouse visits, further delaying payment.

Complexity

While three-way matching is a straightforward process, it may become complicated by departmental specifics. Financial specialists may need to spend extra time learning more about the requester’s needs and purchase order details before matching the documents.

Fraud Risks

Although three-way matching helps detect fake invoices and prevent accidental payment, it cannot guarantee the total elimination of fraud.

Suppose too few procurement officers are responsible for too many documents. In that case, the matching process may be rushed, increasing the chances of mistakes.

Lower Accuracy Risks

When done manually, three-way matching is vulnerable to human error. From misinterpreting contracted terms and miscalculating numbers to simply misplacing the documents, overwhelmed or distracted employees in accounts payable are prone to matching mishaps.

Optimizing Three-Way Matching

As with any process, three-way matching will work smoothly if set up and executed efficiently. Here are some tips to help make the most out of the process:

Set Approval Threshold

Define a purchase value beyond which three-way matching is required. Invoices below this value can be approved for payment automatically, allowing more time to match more expensive purchases.

Define Tolerance Limit

Define a tolerated deviation limit measured in percentages from the purchase order total or set to a specific amount of money.

If an invoice has a discrepancy that is within the tolerance limit, it can still be approved for payment without further investigation.

Evaluate Vendors

Keep track of vendors and suppliers who consistently issue accurate invoices and prioritize purchasing from them. Sharing vendor reviews with team members can help ensure that all procurement officers select the most trustworthy partners.

Over time, AP teams may note that invoices from specific suppliers can be trusted and require only a quick scan.

Automate

Using a technology solution like HubBroker’s integration solutions, three-way matching can happen automatically, guaranteeing faster checking and better accuracy.

Benefits of Automating Three-Way Matching

Manual three-way matching is a time-consuming process prone to human errors. To overcome these challenges, many companies have adopted automated three-way matching software. Here are some of the benefits of automating this process:

Centralization of Data

Automated three-way matching relies on data centralization, where purchase orders, receipts, and invoices are stored in the same place, allowing easy access to required information.

All business data, such as company and item information, is organized in the central database, which makes three-way matching straightforward. This eliminates the need for manual searches and minimizes the risk of data loss.

Minimal Human Intervention

Automated three-way matching uses optical character recognition (OCR) and artificial intelligence (AI) to automatically read and match records, eliminating the need for manual matching.

This helps minimize human errors and inefficiencies, as discrepancies and other issues are highlighted as soon as documents are entered into the procurement system. This ensures that the matching process is accurate, efficient, and scalable, making it ideal for growing businesses.

Customization of Workflows

With automated three-way matching software, managers can create guidelines and workflows that ensure everyone involved in the matching and payment processes is acting within their competencies. Responsibilities are clearly distributed, and everyone knows their role in the process.

By automating the approval process in accordance with customized workflows, the accounts payable team can focus on investigating other invoices’ unmatched details.

Credibility and Better Deals

Automated three-way matching streamlines the matching process, making it possible to authorize payments promptly and benefit from early payment discounts.

By matching and paying invoices on time or ahead of time, buyers can expect to negotiate better prices and credit terms with suppliers, improving credibility and building better business relationships.

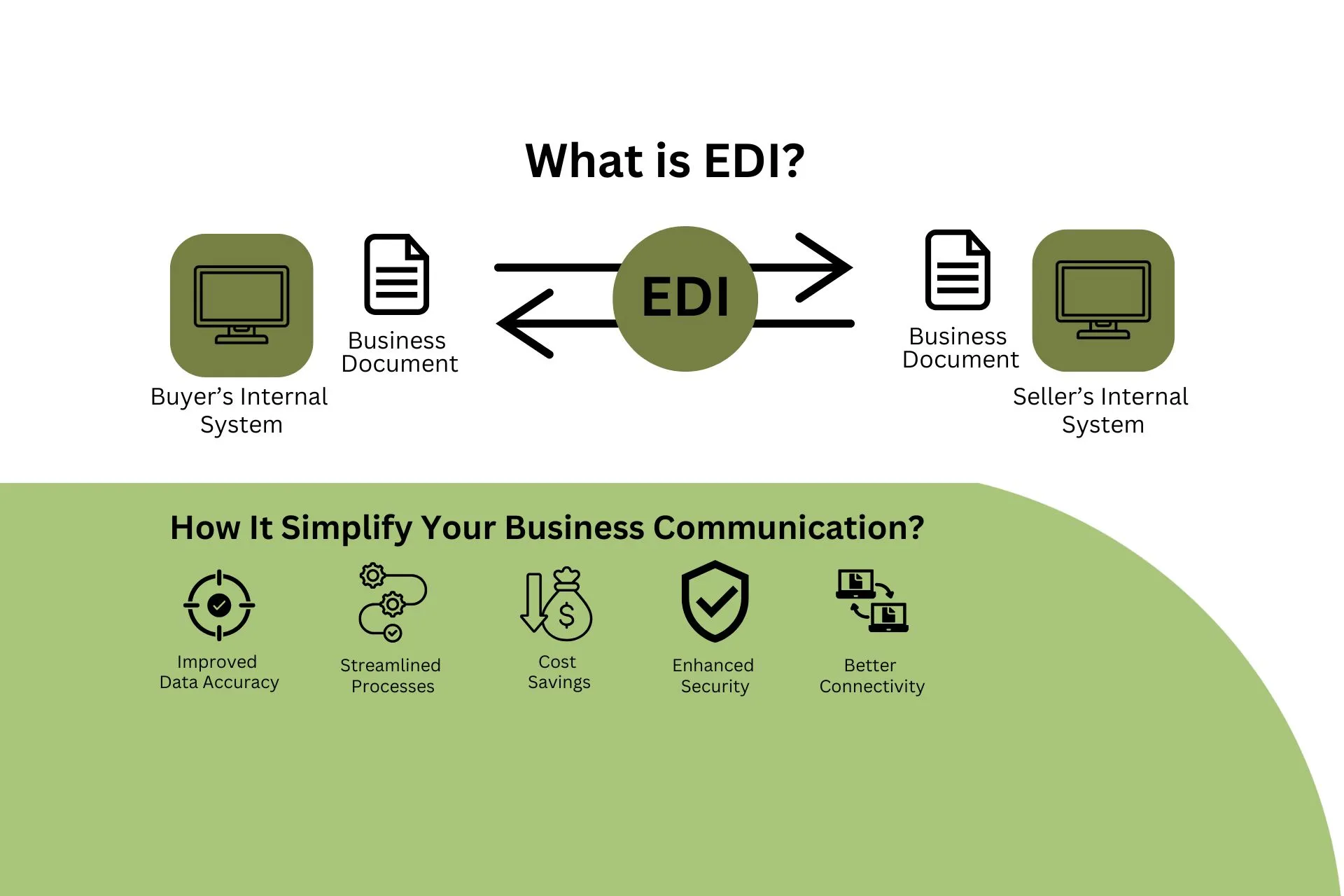

Efficient Integrations

Modern automation solutions like HubBroker’s PDF2XML support integrations for seamless information import and synchronization, enabling the accounts payable team to conduct three-way matching in the procurement software and then directly send the invoice to the accounting or ERP system to be paid and filed for auditing.

This helps avoid manual data entry, reduces the risk of errors, and saves valuable time that can be used for other tasks.

Comprehensive Analytics

Automated three-way matching also provides comprehensive analytics that helps businesses evaluate vendor performance and identify the most frequent issues. AP professionals can gain insights into the quality of current documents and partnerships and offer suggestions on how to develop procurement.

Procurement analytics and accounts payable automation are both essential for a business to operate efficiently. Automated three-way matching saves enterprises time and money, eliminates reputational threats by preventing wrongful funds allocation and late payments, and helps detect fraud attempts.

Conclusion

In conclusion, three-way matching is an essential process in the procurement cycle that confirms the validity of an invoice. It ensures that companies only pay for the goods or services they have received. By cross-referencing the purchase order, receipt, and invoice, companies can quickly identify any discrepancies and resolve them promptly, saving both time and money.

Manual three-way matching can be a tedious and error-prone process, leading to delayed payments, missed discounts, and potential reputational damage. Automation solutions, such as those offered by HubBroker, can centralize all data, minimize human intervention, and provide customization options, among other benefits.

By using automation, companies can efficiently handle a higher quantity of invoices, avoid manual errors and inefficiencies, streamline the matching process, and take advantage of early payment discounts. Automation also provides comprehensive analytics to evaluate vendor performance and offer insights into procurement improvements.

Therefore, companies can significantly benefit from adopting automated solutions for three-way matching, allowing them to focus on more valuable tasks while minimizing risks and enhancing efficiency.

Book a demo today to see how HubBroker’s automation and integration solutions can help your business streamline three-way matching.